Gildan released 4th Qtr and full 2016 earnings and their forecasts for 2017.

In their own words:

- Net sales growth of 8.1% in the fourth quarter

- GAAP diluted EPS and Adjusted diluted EPS of $0.32, both up 14% compared to Q4 2015

- 2017 Adjusted diluted EPS guidance of $1.60-$1.70, representing 9% growth over 2016 at midpoint of range

- Record free cash flow of $398 million for full year 2016 exceeds Company’s guidance

- $470 million returned to shareholders through dividends and share repurchases during 2016

- Fifth consecutive annual 20% increase in quarterly dividend

- Renewal of normal course issuer bid to repurchase up to 5% of issued and outstanding common shares

Roughly translated, they did really well, with gross sales of 2.59 Billion Dollars. Their purchase of Alstyle increased their Printwear division sales in the 4th quarter by $30 million. The printwear division sales were up 14.4% over 4th qtr 2015.

Announcements of cash generated and stock buyback plans indicate a very strong company performance and lead them to a strong forecast for 2017.

Another tidbit from their report: “…organic unit sales volume growth driven by strong double digit volume growth in international printwear markets.” At least if you look internationally, according to the giant of our industry, our business is growing.

Reports are that after this financial report on 4th qtr and 2016 that they will move on to announcements on what they will be doing with American Apparel.

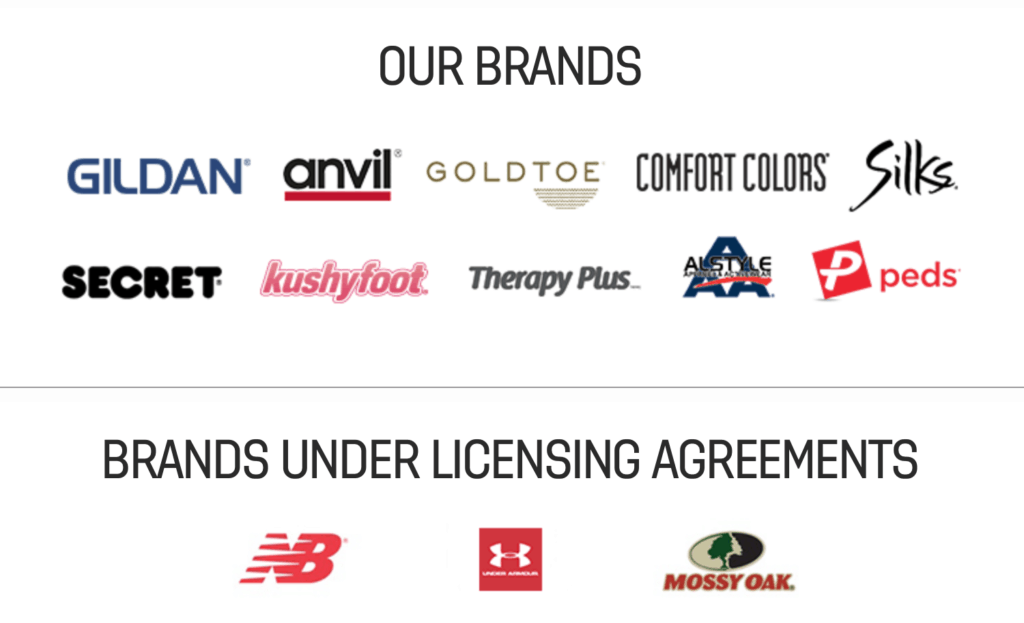

The Gildan empire of brands:

Comments